My team at Xponance runs multi-manager products. We were frustrated with what was available to analyze performance. Holdings-based analytics didn’t give us the full picture. I remember one asset manager that pitched us that their product was defensive. According to their holdings, it seemed to track, but using returns-based analytics we determined what they were delivering was not in fact defensive. We used returns-based analytics to ask better questions and to make portfolios that are properly diversified using factors.” -Cesar Gonzales, Director, Manager Development and Client Portfolio Manager, Xponance

I have worked in the asset management business for almost twenty years. Nine years at Legg Mason, three at T. Rowe Price and five at Brown Advisory. How come throughout all those years, I have only known holdings-based analysis?

When I would relay the story of how my portfolio managers ran their portfolios, I always wondered how analysts check how that story actually played out. In RFPs, they would ask in what market environments the product would outperform or underperform. Do they just take our word? Said another way, is the asset manager playing their role in the asset allocation, or are they zigging when they were supposed to be zagging?

The procedure of separating an investment portfolio into a subset by running a regressing the determining what type of investment behavior an investor or money manager employs based on some quantifiable criteria. Most commonly used in US Equity Markets: Size = Small Cap to Large Cap and Valuation = Value to Growth. This allows investors to gain insight into a portfolios.

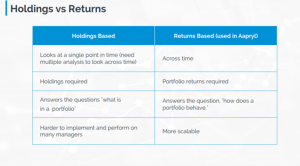

Holdings Based classifies portfolio based on the securities inside of a portfolio. Returns Based uses regression analysis to compare portfolios to market indices representing the various styles.

Ok. I have read and even studied returns-based analysis. You may have heard of Nobel Prize winner William Sharpe. Sharpe ratio? He classified investments using only portfolio returns and employed Multifactor Regression models using common market indices (partitioning the market). But has anyone been using this?

There is definitely interest in the Manager Research community. I was speaking with a Head of Research at a Wirehouse. They spent a lot of money to properly incorporate performance-based analytics into their process. He was surprised by the number of firms that haven’t made such an investment. It’s like you are looking at ¾ of a picture and assuming the remaining part matches your vision of what it is.

To make sure your asset allocation is based on your assumptions and that your goals are met, each asset manager needs to play their role. Back to the quote from Cesar, if you are supposed to be defensive and the returns you give are anything but, then that is a problem. Manager research teams need the full picture and asset managers should understand what they deliver.

Time to dust off those books on Sharpe, or find a tool that can paint the missing part of your picture. Then at least you can be proud to hang it on your wall.