Aapryl’s analytics solve lingering industry problems to give you unique insights into investment managers.

Our goal was to create a product that allows managers to not only understand their portfolio at a deeper level, but also be able to communicate their value to clients in a clear and concise manner. Aapryl provides investment managers the ability to present their information to current and prospective clients in a manner that clients can understand easily with in the context of their true peers:

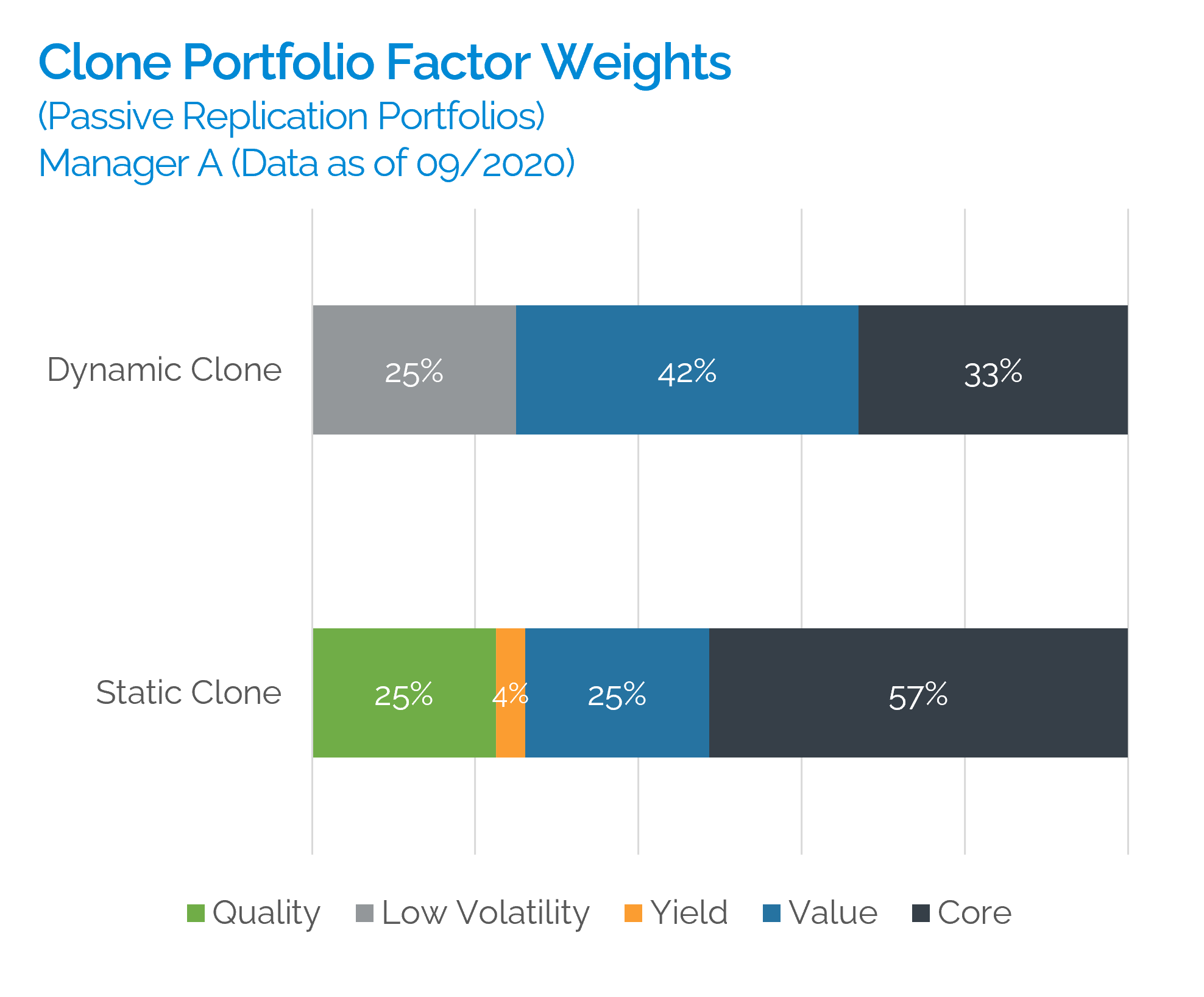

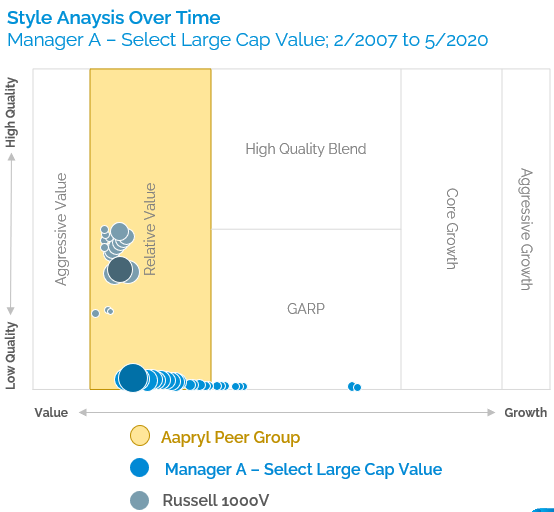

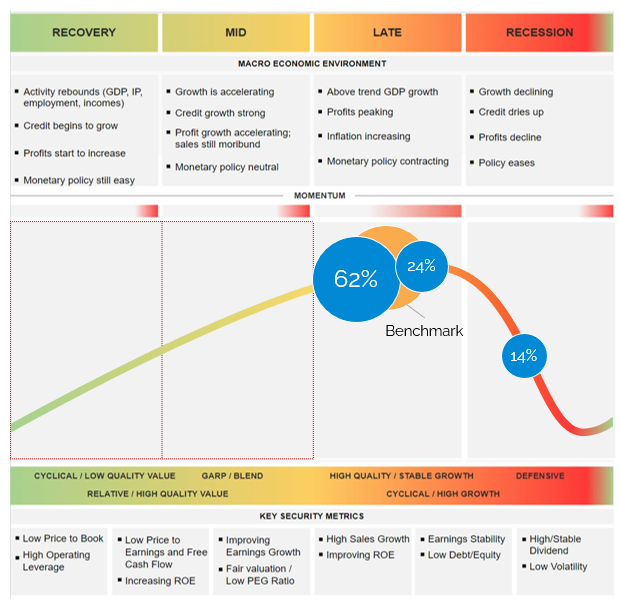

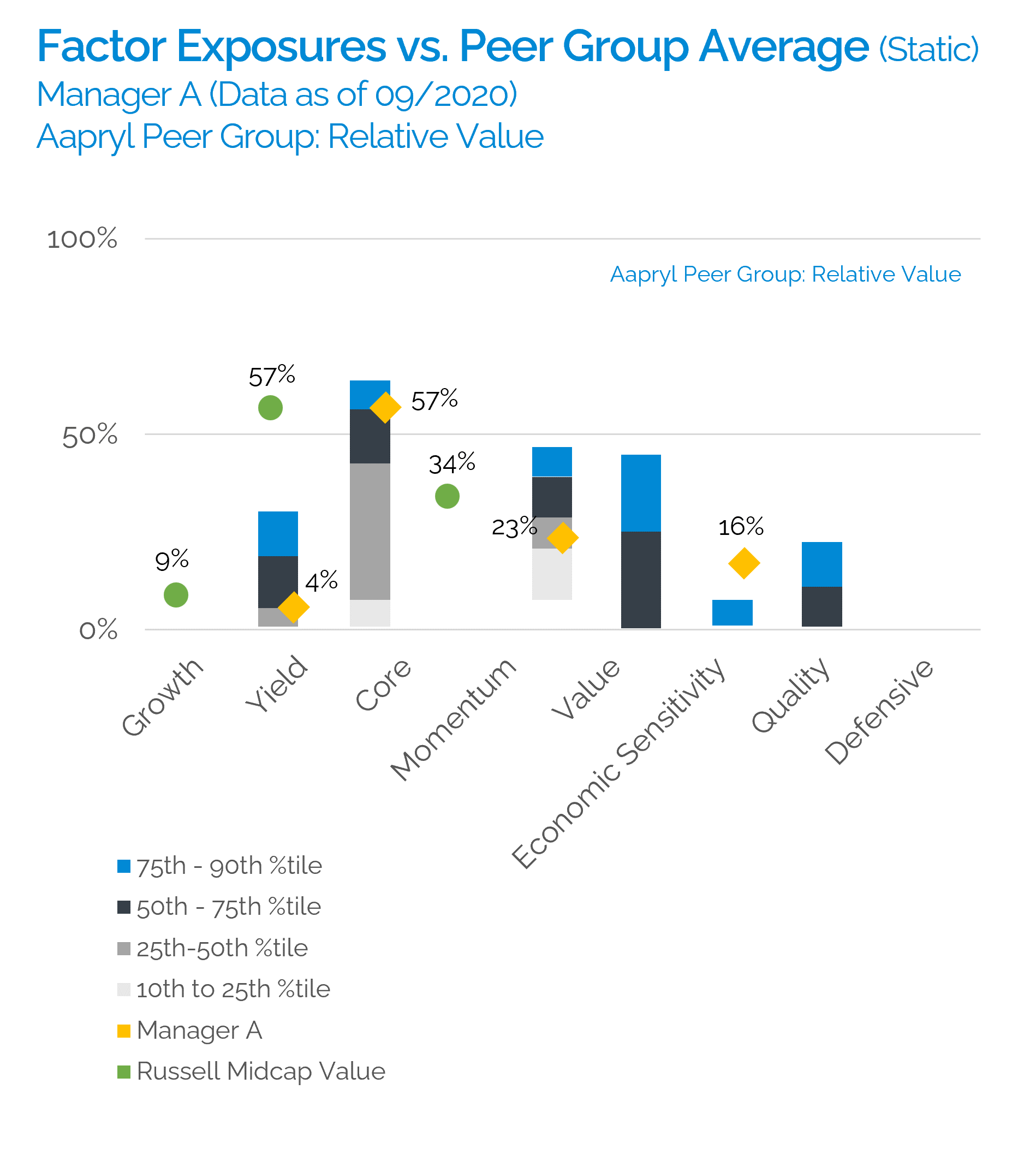

Benchmarks by which managers assess themselves are too broad, and thus fail to define the true style of a given asset manager. Aapryl’s portfolio replication methodology and proprietary factor mapping system allows managers to clearly show how they differ from the benchmark as well as their peers. We address this problem by building 2 clone portfolios using returns based analysis (RBSA), where a time series of portfolio returns are regressed against a number of factors to explain what’s driving performance. Instead of providing a metric of either success or failure, this tool allows a manager to disaggregate their portfolio to find out what has been driving returns, when are they successful, what areas can they improve in, and most importantly how their product fits within a client’s portfolio.

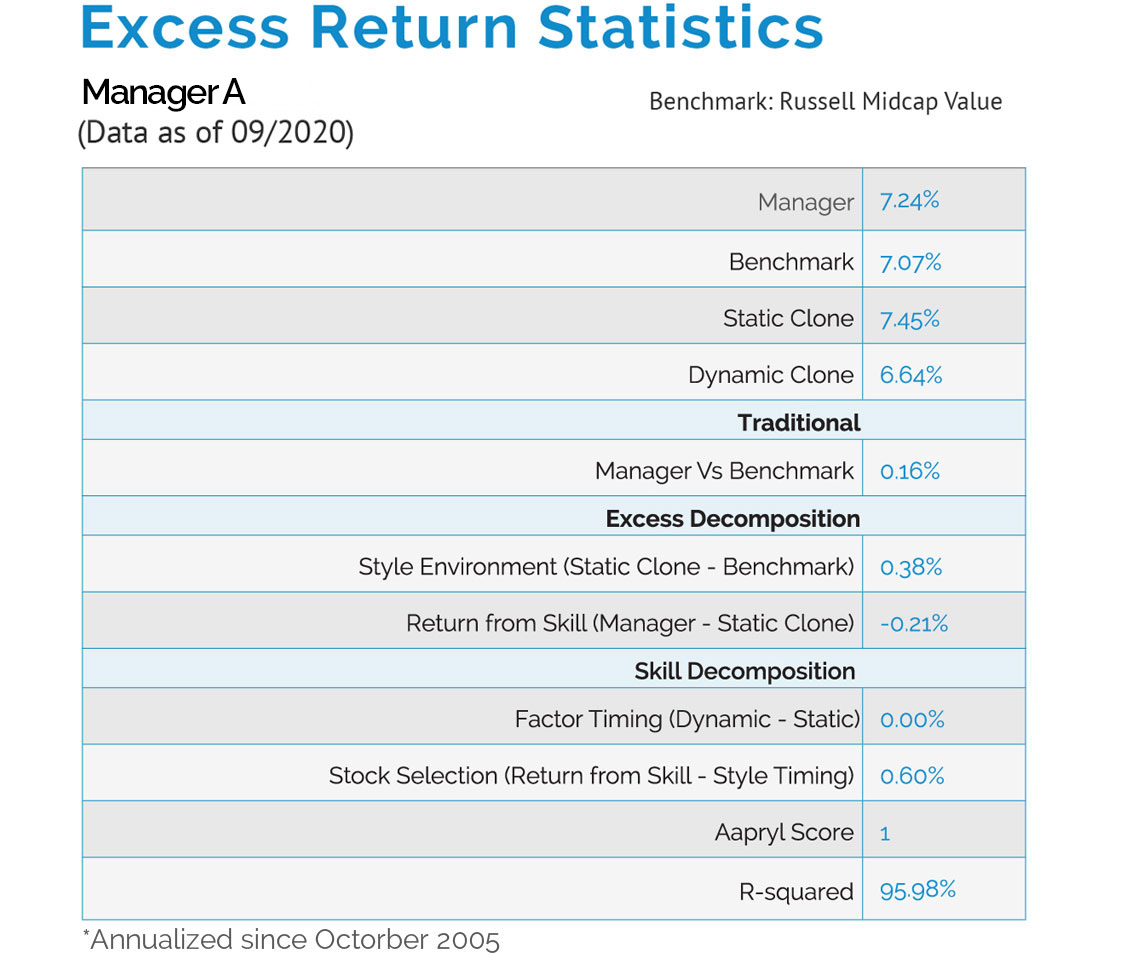

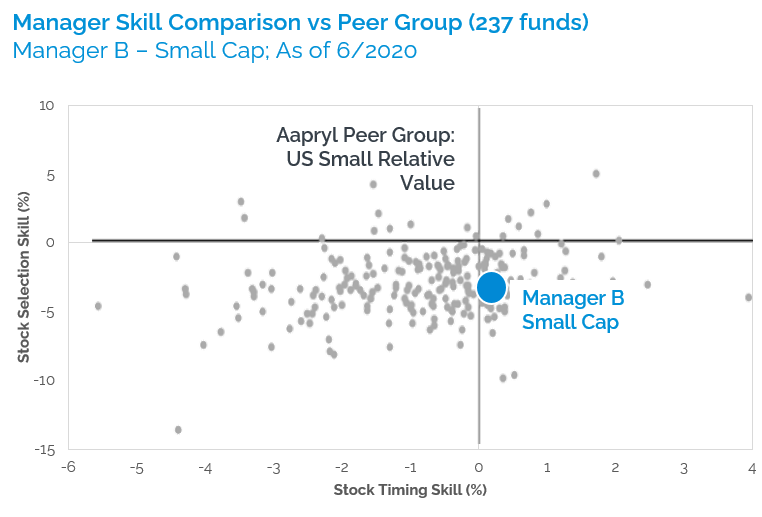

Aapryl provides managers with an intuitive framework for explaining the contributions to performance derived from their product’s style environment, stock selection and style timing. Once a manager’s style is identified, their “true excess return” or skill can be calculated and decomposed. Traditionally, Excess Return or alpha is calculated as the difference between the manager’s return and it’s stated benchmark. Aapryl breaks down the traditional alpha further by stripping the style return away from its traditional Alpha, focusing on returns directly attributed to the manager’s active decisions and hence its true Alpha.

Aapryl does a better job at comparing investment managers to their more specific peer groups than other platforms. When comparing managers to other managers, utilizing benchmark as the sole filtering criteria is not sufficient; a manager’s true style can vary significantly from their stated benchmark. Peer rankings provide a general view of how a product has done versus their benchmark, but through style clustering, Aapryl can help investment managers understand how they have done versus other managers who have similar characteristics to them. Excess return and thus, manager skill, can be compared to more like peers.

Fill the form below and receive your complimentary Aapryl Report on a specific manager product.