Jeremy Grantham

“90% of what passes for brilliance or incompetence in investing is the ebb and flow of investment style”

Jeremy Grantham

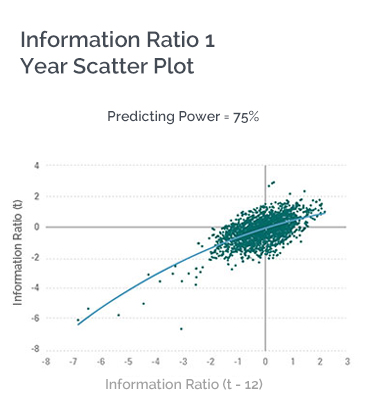

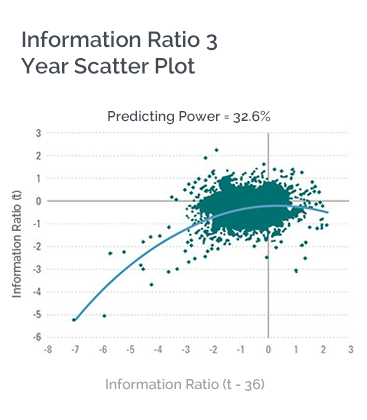

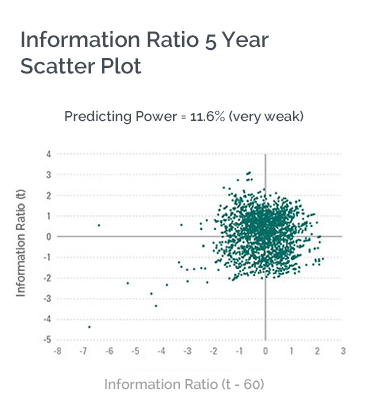

Are more predictive of future investment performance

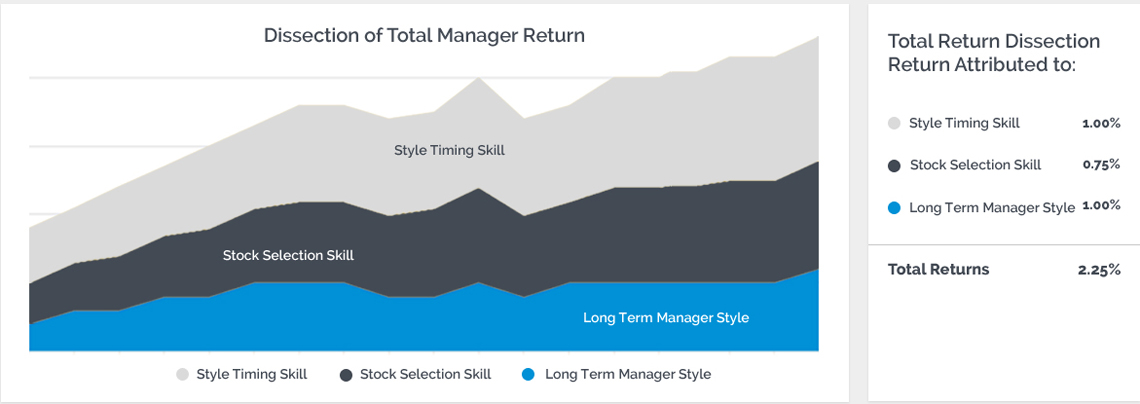

Distinguish luck from skill and alpha from investment style

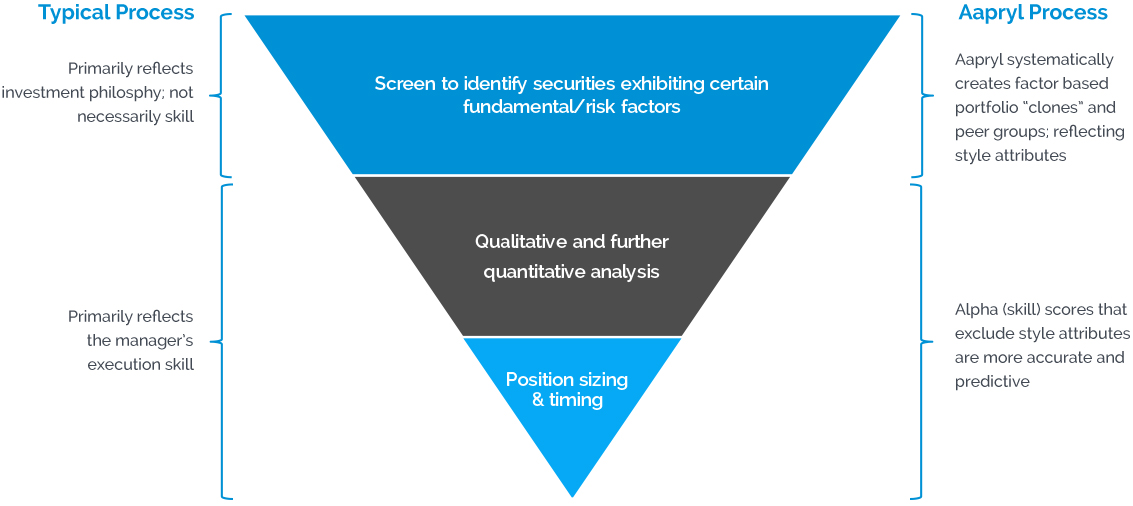

Calculate the factor betas endemic to a manager’s investment process

Produce refined factor-based peer groups that go beyond broad investment styles

Estimate alpha more accurately to improve portfolio optimization

Visually identify the best and worst market conditions for a manager product or composite portfolio