Aapryl’s analytics solve lingering industry problems to give you unique insights into investment managers. The insights are provided in a cost effective manner that not only save you time and resources, but empower you to make better investment decisions. These are the 5 ways that Aapryl empowers you:

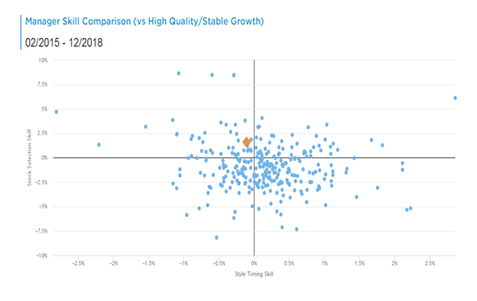

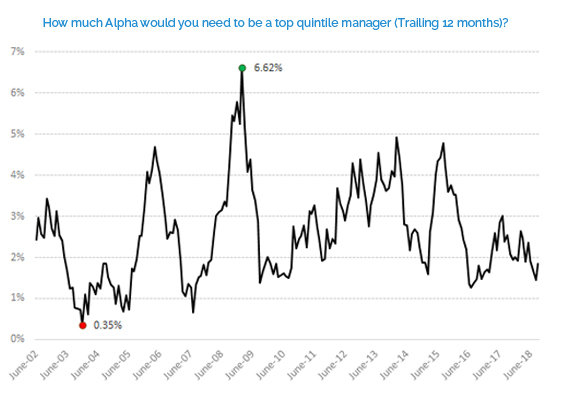

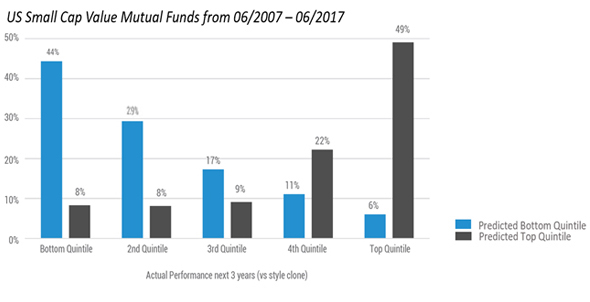

1) Predictive Analytics

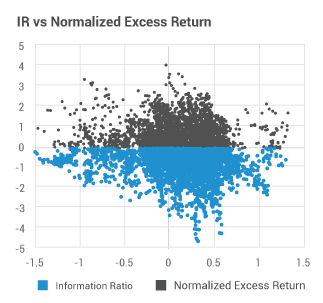

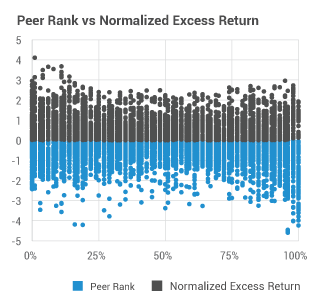

Problem: Traditional manager performance measurements (such as Information Ratio and Peer Group rankings) are useful for characterizing past performance; but they are not predictive.

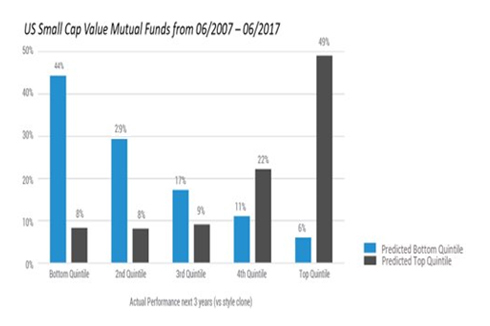

Solution: Aapryl’s manager skill prediction algorithms increase the likelihood of choosing tomorrow’s top performing managers, rather than yesterday’s.

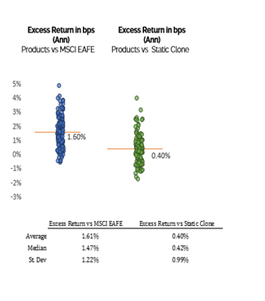

2) More Precise Performance Benchmarks and Peer Groups

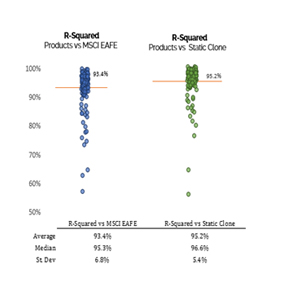

Problem: Performance benchmarks and peer groups are frequently imprecise measurements of manager skill.

Solution: Aapryl’s portfolio replication “clones”, based on the manager’s longitudinal factor profile, render more accurate benchmarks and are used to create more relevant peer group insights.

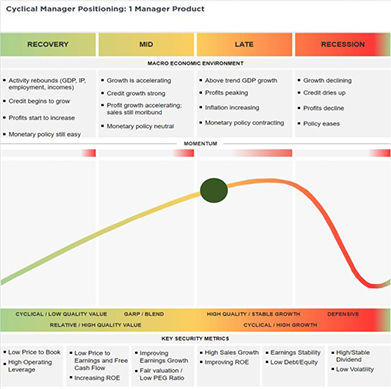

3) Contextualize Manager Performance in Different Market Conditions

Problem: Managers’ performance is cyclical and varies under different market conditions.

Solution: Aapryl normalizes manager skill estimates, contextualizes the market conditions under which they are likely to outperform, and renders more optimal and comprehensive portfolio construction.

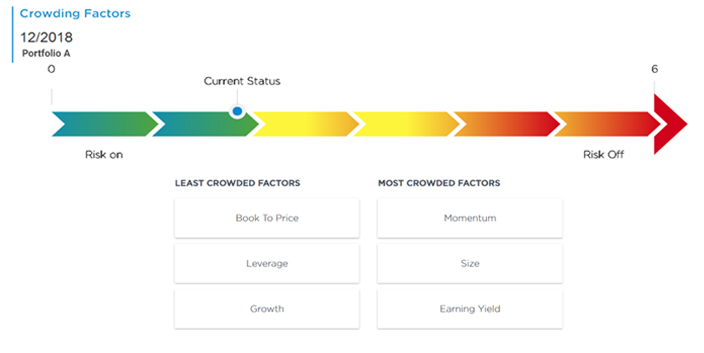

4) Factor Crowding Warning

Problem: When factors dominate market performance over prolonged periods, portfolio diversification deteriorates and multi-manager portfolios can become vulnerable to “factor crashing” after market reversals.

Solution: Aapryl’s crowding module allows allocators to evaluate their portfolio’s factor diversification and the risk of factor crashing.

5) Cost Effective Data Integration and Analysis

Problem: There are thousands of investment products to evaluate and your time is finite and precious.

Aapryl integrates data from multiple data providers:

~6,500 separately managed accounts

~42,000 mutual funds

~3,600 ETFs.

Solution: Aapryl saves time and expense by integrating large volumes of data from 3rd party sources to hone in on what’s important – skill.