The Aapryl Quarterly Market Insight offers a lens on how active managers in general performed in various markets and sub-segments. Using Aapryl’s proprietary methodology, we measure manager skill by using the manager’s static clone (long term factor profile) as a measure of skill instead of the broad market benchmark. Manager skill is calculated by using the manager’s raw return less their static clone return.

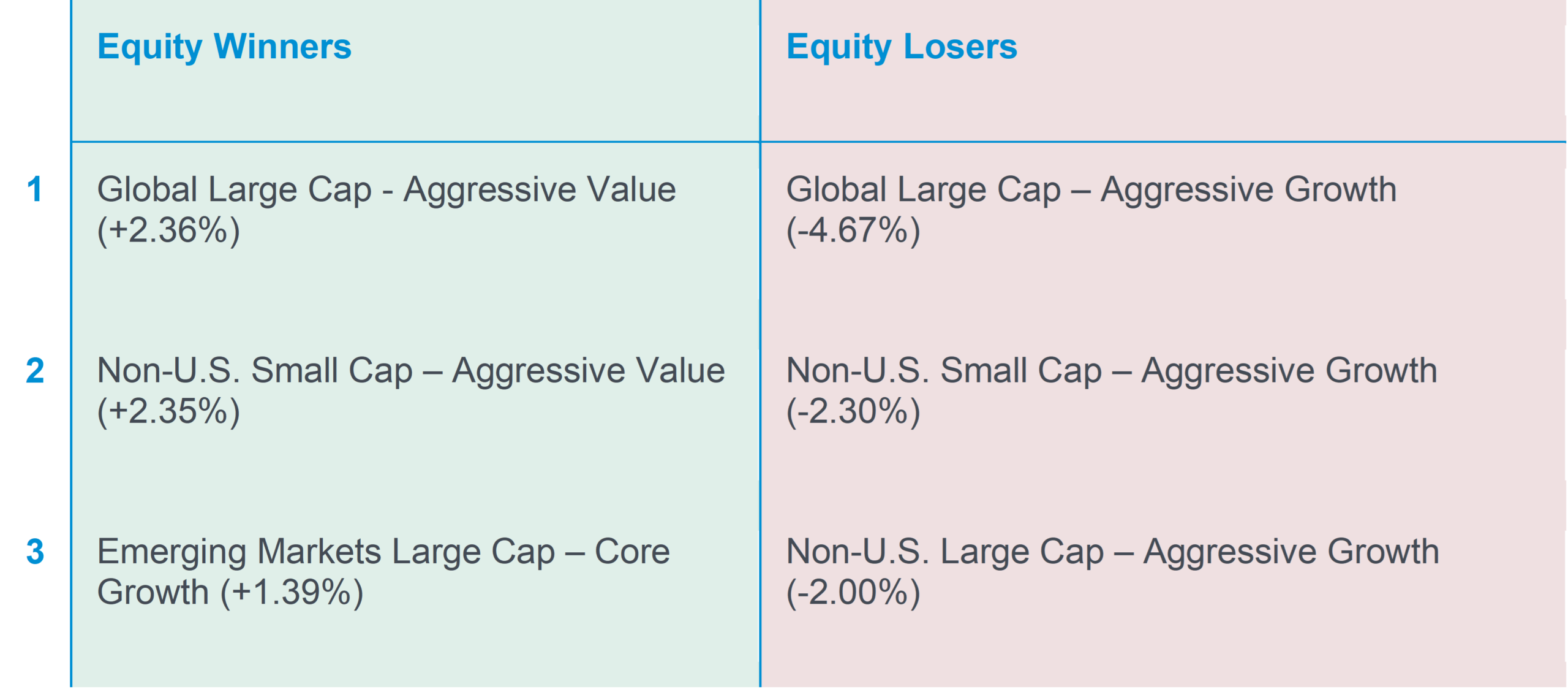

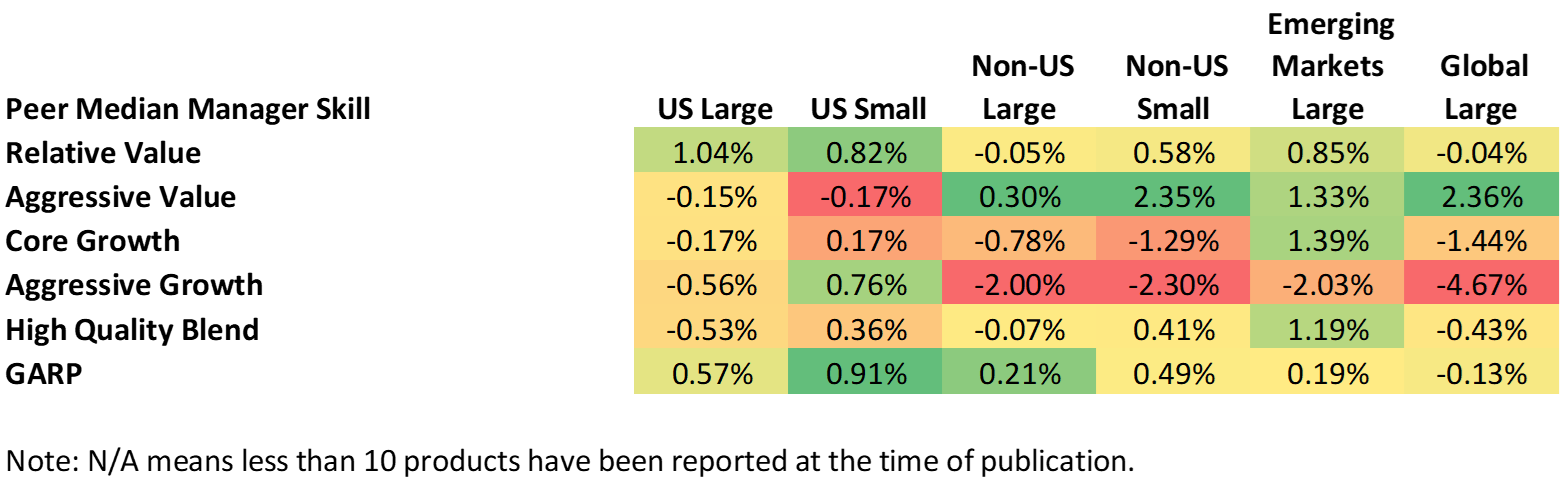

The 4th quarter of 2025 continued to be a low-quality rally globally except in U.S. as expressed by Aggressive Value strategies led by Global Large Cap +2.36% and Non-U.S. Small +2.35%. The story is very different within the Aggressive Growth globally excluding the U.S. were sizeable losses were incurred by active managers as see by the median managers in Global Large Cap -4.67%, Non-U.S. Small -2.30%, and Non-U.S. Large Cap -2.00%.

Below are the top three winners and bottom three losers based on the performance of their respective peer group medians for the prior quarter:

Aapryl Peer Group Manager Skill Performance Matrix

Quarter Ending 12/31/2025

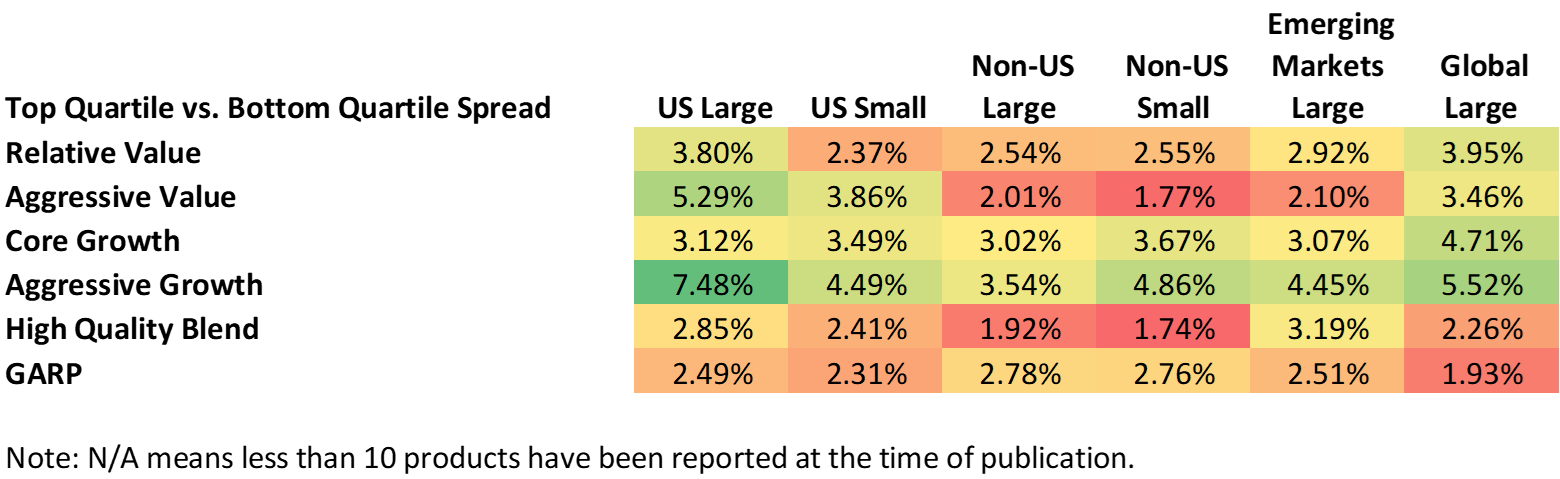

The performance spread between the top and the bottom quartile within their respective peer groups varied for each Aapryl peer group is shown below. We saw another big spread difference Aggressive Growth peer groups ranging from 7.48% up to 3.54%. The biggest performance spread between the peer groups top quartile vs bottom quartile were in U.S. Large Cap Aggressive Growth 7.48%, with the lowest spread occurred in Non U.S. Small Cap High Quality Blend 1.74%.

Top Quartile vs. Bottom Quartile

Quarter Ending 12/31/2025

Fixed Income Manager Performance During the Quarter

Active managers in Fixed Income continue to show performance differences between top and bottom quartile managers. The highest spread this quarter continued to be in EM Bond Intermediate Term All Spread 1.94% (previous quarter was 1.31%), while Short Investment Grade Intermediate Term All Spread Risk had the lowest spread of 0.08% (previous quarter was 0.19%). The High Yield Short Term All Spread median managers performed the best with +0.29%, while Global Bond Long Term All Spread performed the worst during the quarter with -0.22% median return.

Quarter Ending 12/31/2025