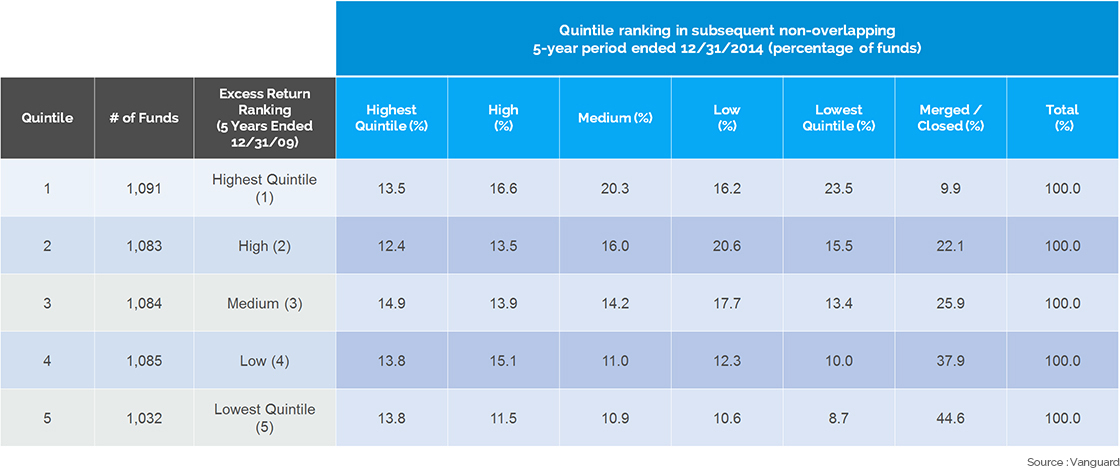

| # of Funds: | 1,097 |

| Excess Return Ranking (5 Years Ended 12/31/09): | Highest Quintile (1) |

Quintile ranking in subsequent non-overlapping 5-year period ended12/31/2014 (percentage of funds)

| Highest Quintile (%): | 13.5 |

| High (%): | 16.6 |

| Medium (%): | 20.3 |

| Low (%): | 16.2 |

| Lowest Quintile (%): | 23.5 |

| Merged/ Closed (%): | 9.9 |

| Total (%): | 100.0 |

| # of Funds: | 1,083 |

| Excess Return Ranking (5 Years Ended 12/31/09): | High (2) |

Quintile ranking in subsequent non-overlapping 5-year period ended12/31/2014 (percentage of funds)

| Highest Quintile (%): | 12.4 |

| High (%): | 13.5 |

| Medium (%): | 16.0 |

| Low (%): | 20.6 |

| Lowest Quintile (%): | 15.5 |

| Merged/ Closed (%): | 22.1 |

| Total (%): | 100.0 |

| # of Funds: | 1,084 |

| Excess Return Ranking (5 Years Ended 12/31/09): | Medium (3) |

Quintile ranking in subsequent non-overlapping 5-year period ended12/31/2014 (percentage of funds)

| Highest Quintile (%): | 14.9 |

| High (%): | 13.9 |

| Medium (%): | 14.2 |

| Low (%): | 17.7 |

| Lowest Quintile (%): | 13.4 |

| Merged/ Closed (%): | 25.9 |

| Total (%): | 100.0 |

| # of Funds: | 1,085 |

| Excess Return Ranking (5 Years Ended 12/31/09): | Low (4) |

Quintile ranking in subsequent non-overlapping 5-year period ended12/31/2014 (percentage of funds)

| Highest Quintile (%): | 13.8 |

| High (%): | 15.1 |

| Medium (%): | 11.0 |

| Low (%): | 12.3 |

| Lowest Quintile (%): | 10.0 |

| Merged/ Closed (%): | 37.9 |

| Total (%): | 100.0 |

| # of Funds: | 1,032 |

| Excess Return Ranking (5 Years Ended 12/31/09): | Lowest Quintile (5) |

Quintile ranking in subsequent non-overlapping 5-year period ended12/31/2014 (percentage of funds)

| Highest Quintile (%): | 13.8 |

| High (%): | 11.5 |

| Medium (%): | 10.9 |

| Low (%): | 10.6 |

| Lowest Quintile (%): | 8.7 |

| Merged/ Closed (%): | 44.6 |

| Total (%): | 100.0 |

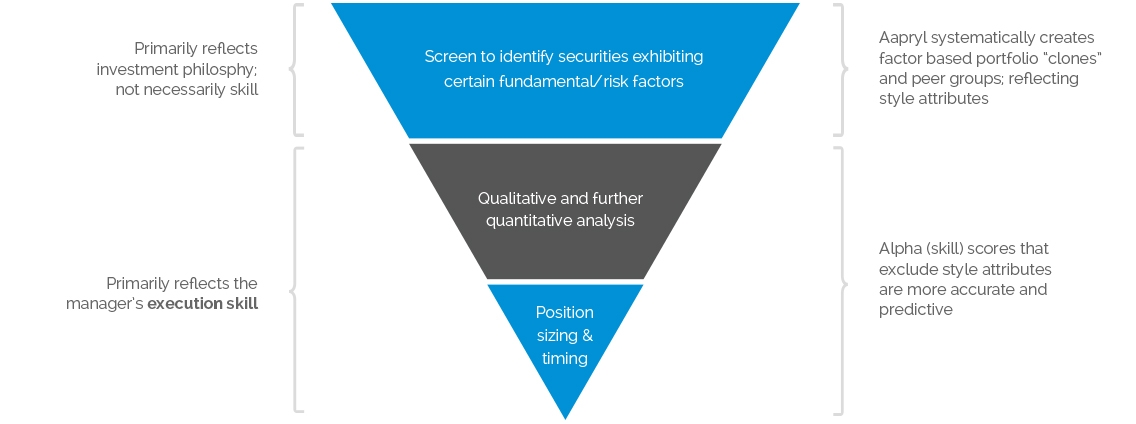

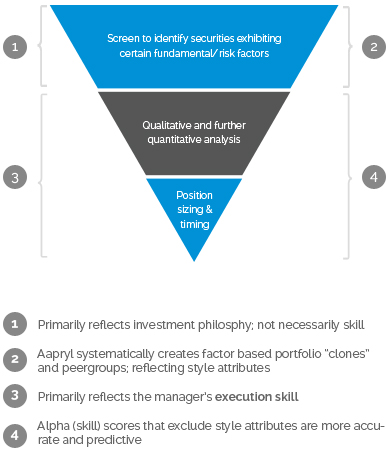

Aapryl’s Perspective on a

Typical Manager’s Investment Process