Aapryl’s analytics empower you with intuitive and coherent solutions for understanding and explaining your investment performance and portfolio risks. These are the 5 ways that Aapryl empowers managers:

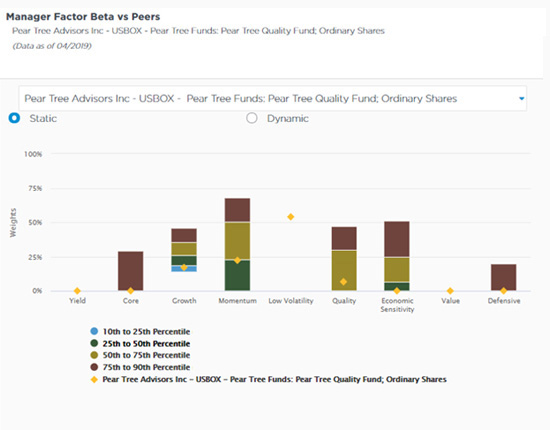

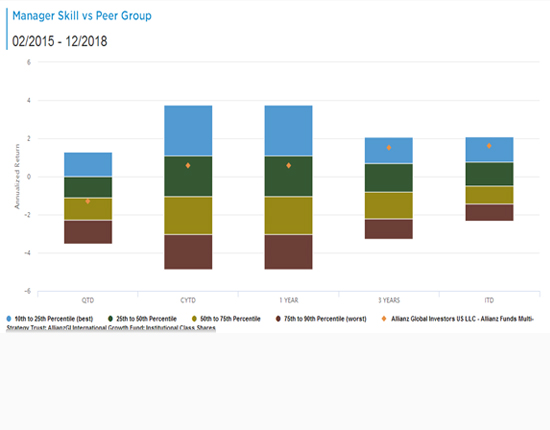

1) Provide better comparisons than traditional Peer Groups & Benchmarks

Problem: Active managers’ return variance can be misunderstood due to clients’ reliance on imprecise benchmarks or poorly constructed peer groups to evaluate their performance.

Solution: Aapryl’s portfolio replication methodology and proprietary factor mapping system allows managers to clearly show how they differ from the benchmark as well as their peers.

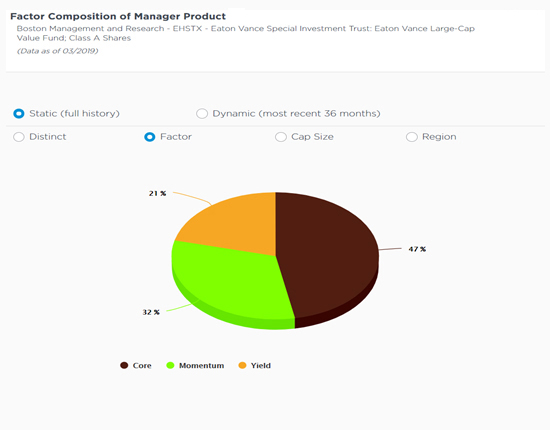

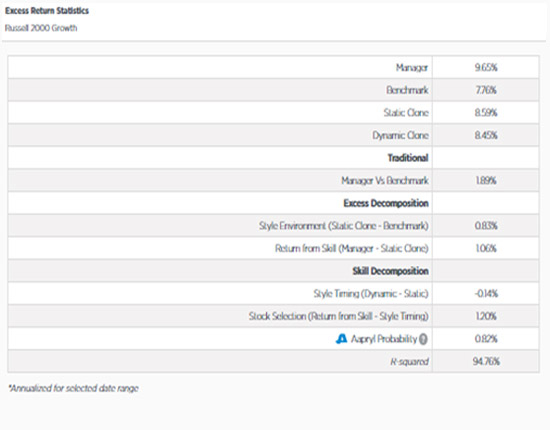

2) Clearly demonstrate the impact of Style effects on performance

Problem: Managers want a more precise and intuitive framework for demonstrating the impact of style effects on their performance relative to market benchmarks and peer groups.

Solution: Aapryl’s proprietary analytics help managers to clearly demonstrate the impact of style effects on their performance relative to market benchmarks and peers.

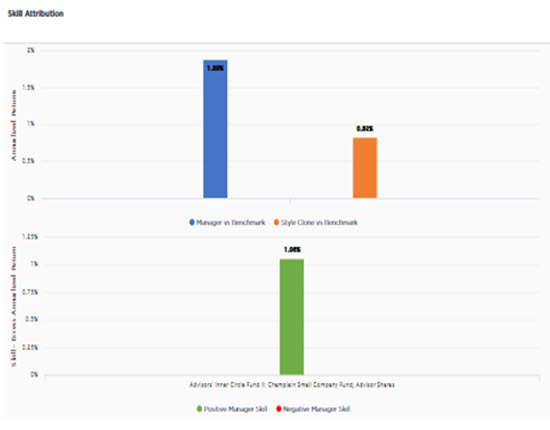

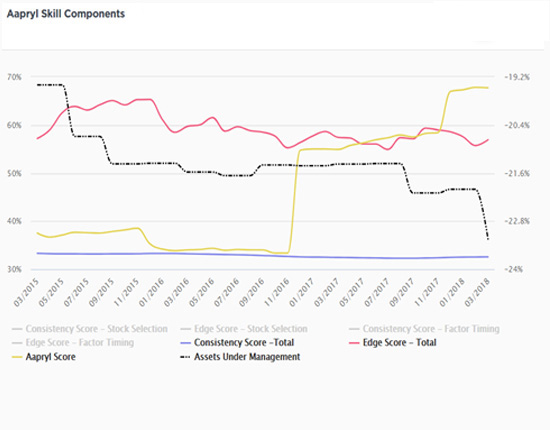

3) Utilize an intuitive framework that explains alpha generation

Problem: Managers want a precise and intuitive framework for demonstrating how they generate alpha.

Solution: Aapryl provides managers with an intuitive framework for explaining the contributions to performance derived from their product’s style environment, stock selection and style timing.

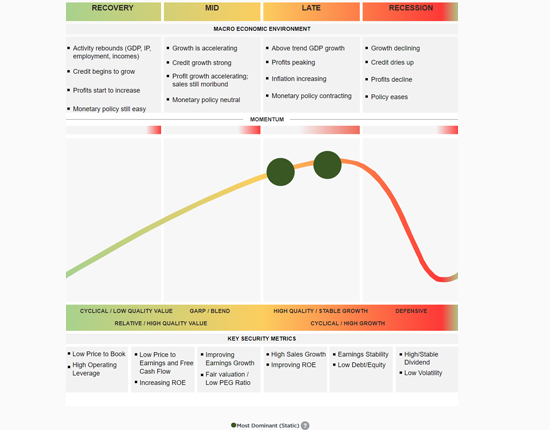

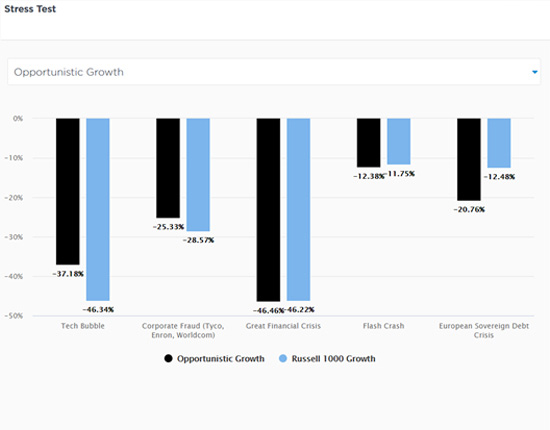

4) Define market conditions that likely favor or challenge your investment process

Problem: Managers want to more clearly understand and demonstrate how their portfolio would be expected to perform in different economic and market environments.

Solution: Aapryl provides an intuitive framework for managers to demonstrate the market conditions that are likely to favor or challenge their investment process and provide a view on how they would have performed during prior periods of market stress.

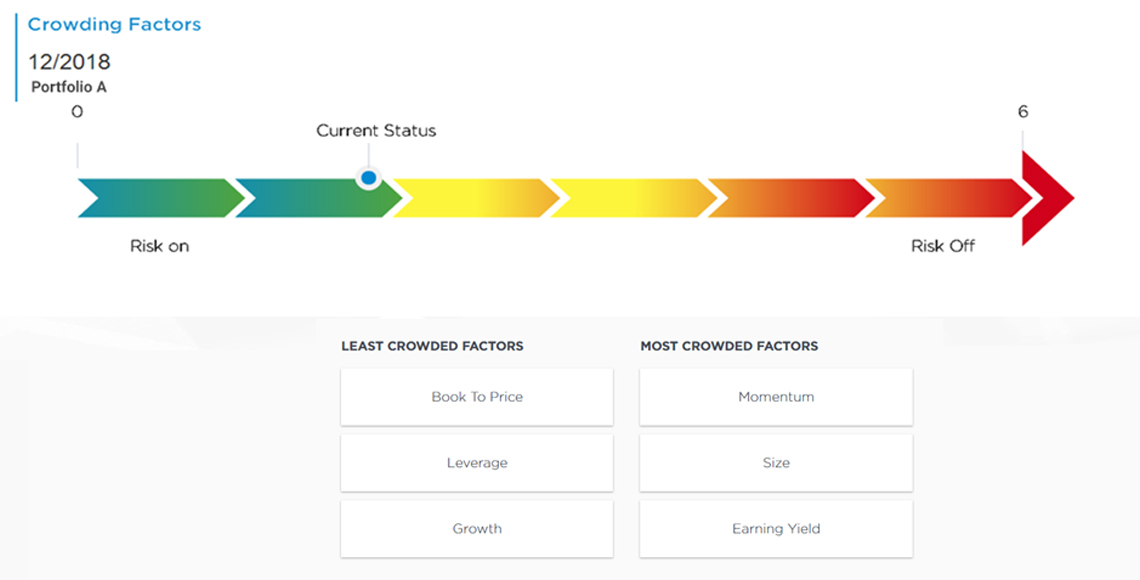

5) Evaluate your portfolio for factor crowding & crashing risk

Problem: When factors dominate market performance over prolonged periods, portfolio diversification deteriorates, and manager portfolios can become vulnerable to “factor crashing”.

Solution: Aapryl’s crowding module allows investment managers to evaluate their portfolio’s factor diversification and the risk of factor crashing.